Stoneshield believes that ESG can have a material impact on long-term investment outcomes. Our goal is to achieve the best possible risk-adjusted returns for our clients, taking into account all factors that influence investment performance.

Our approach to ESG is based on the following principles

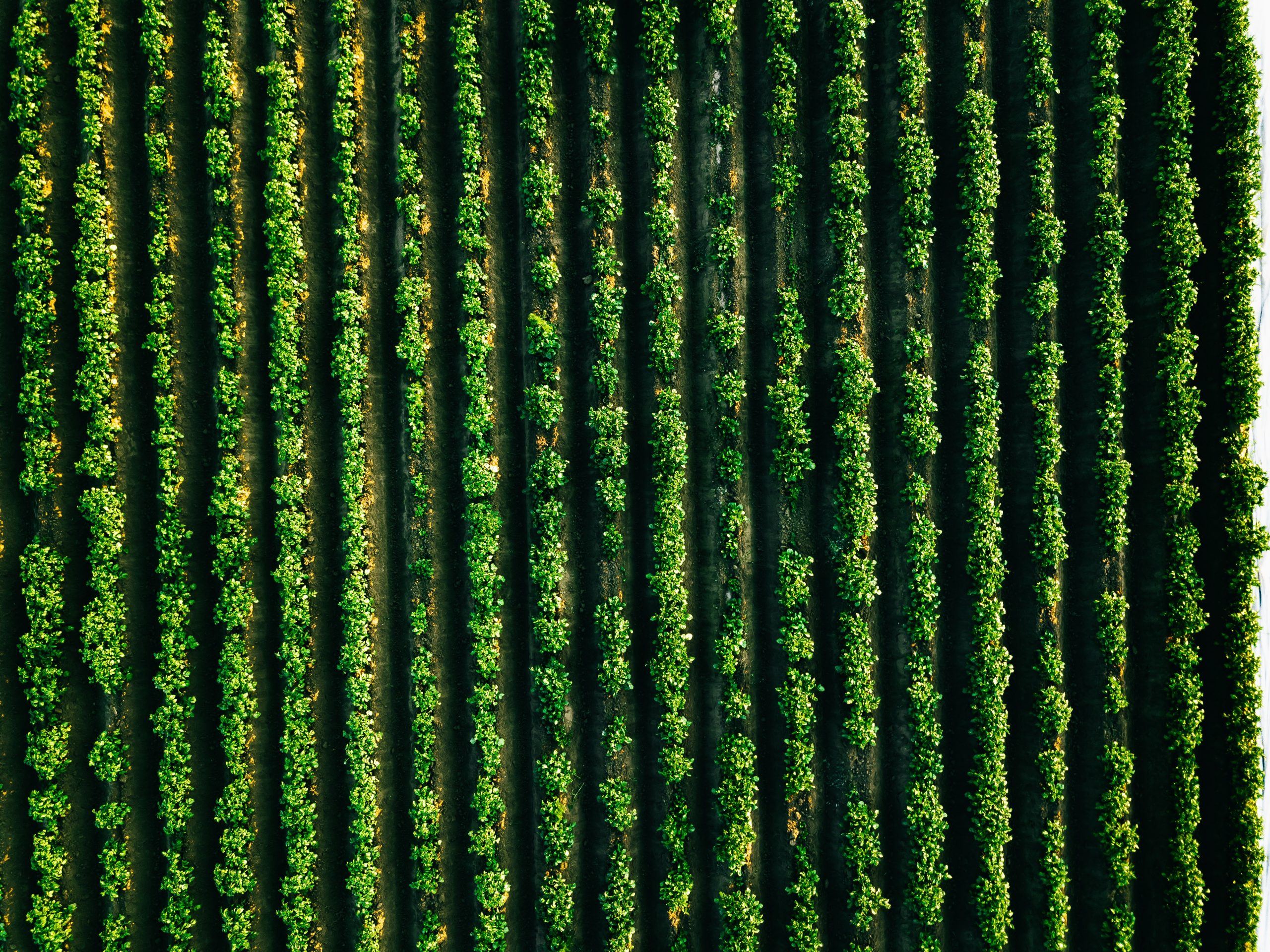

We strive to mitigate the impact of our operations on the environment as we understand that most of our operations, businesses and assets are both impacted by and have an impact on the environment, including climate change. We believe, to address climate change, the world will have to transition to a net zero-carbon economy. We are proactively evolving our portfolio of investments consistent with this imperative.

We strive to ensure the development, well-being, and health and safety of our employees. Our people must succeed for us to succeed. We place a high priority on creating a safe and inclusive work environment, which supports development of potential and personal growth. This is reflected in our human capital policies and processes and extends to the health and safety practices within our portfolio companies.